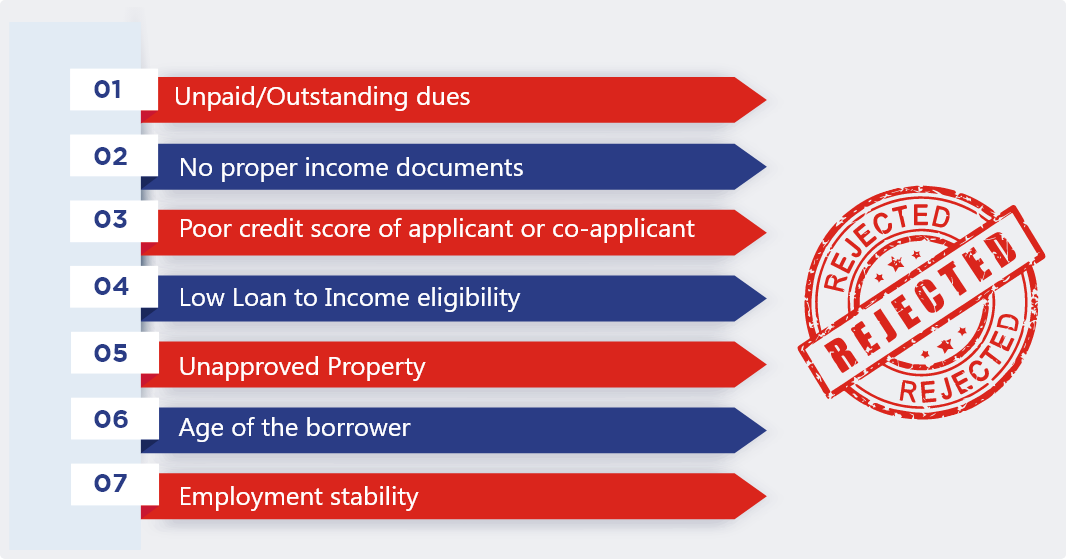

Reasons for Home Loan Rejection

Home Loan Rejection really breaks the heart. But despite all the checks made by you, many of your home loan applications still get rejected.

When you apply for a home loan there are few important points that the lender doesn’t want to miss out and these factors are your break or make points, some of the main factors are your monthly income and your credit score. Either of them is not fulfilling the application criteria, your loan can be rejected.

Apart from these the lender will also look out for age factor of the primary income earner, employment factor, any unpaid dues, property, or income related documents etc. Listed below are some of the common reasons for a home loan rejection and this can guide you briefly through all the points that are important for any financial institution to further process your loan application:

- Unpaid/Outstanding dues

- No proper income documents

- Poor credit score of applicant or co-applicant

- Low Loan to Income eligibility

- Unapproved Property

- Age of the borrower

- Employment stability

Poor credit score of applicant or co-applicant:

Borrowers credit score plays an important role in loan approval process and is the most important point among all. A bad credit score will break the deal and a good credit score can make one. Always make sure that you maintain a good credit score whenever you are applying for a loan. To know more about how to maintain a good credit score click here.

Unpaid/Outstanding Dues:

If you have any unpaid/outstanding dues on your other loan or credit card, then that can be a problem in your loan approval. Every lender thoroughly checks on any pending payments and EMIs on any existing loan or credit card. The best way to keep away of this situation is timely payments of dues and EMIs on due date. It is essential to keep a timely check on your credit record and be aware of any dues and payments.

No Proper Income Documents:

No proper income documents can be the one of the biggest hurdles in your home loan application approval. If you don’t have proper documentation to prove your monthly/yearly income, then this can lead to the rejection of your home loan application. Make sure you have proper documents to prove your earning like Salary Slips, Income Tax Return, bank statements etc. before applying for a home loan. Always keep a check on your documents and keep them updated as per the latest records.

Low Loan to Income eligibility:

This is another most common reason for a loan application rejection. In general, your total monthly repayment/obligation should not be more than 50% of your monthly income. Informing the financial institution beforehand about your currently running car/bike loan, personal loan or any consumer loan is the best option. Your lender can check your loan to income eligibility accordingly. However, applying for a joint home loan by clubbing your family income always increases the loan to income eligibility.

Unapproved Property:

Lenders makes sure that the property taken on loan is approved by the local bodies or not. If the property is not verified on certain guidelines, then there are chances that your loan may not be approved by the bank.

Age of the borrower:

The age factor is also a common reason for loan rejection. Chances of loan application getting rejected is high if the borrower’s age is not within the age norms of the lender. The lender checks the age and approve the loan based on the repayment capacity of the borrower and usually the lender hesitates to give loan to such age groups. However, it may be the case where a financial institution may give you a loan for a shorter tenure but that will lead to higher EMI or higher interest rate.

Employment / Business Stability:

Employment stability is an important aspect in your loan approval. If you keep changing your job very frequently then this will impact your chances of getting loan. Banks strictly look out this factor that the applicant must be working in a company for minimum 6 months to 1 year time, in some cases 3 years of continue service is also taken into consideration.

- Share