Loan Interest Rates : Floating vs Fixed

FIXED INTEREST RATE

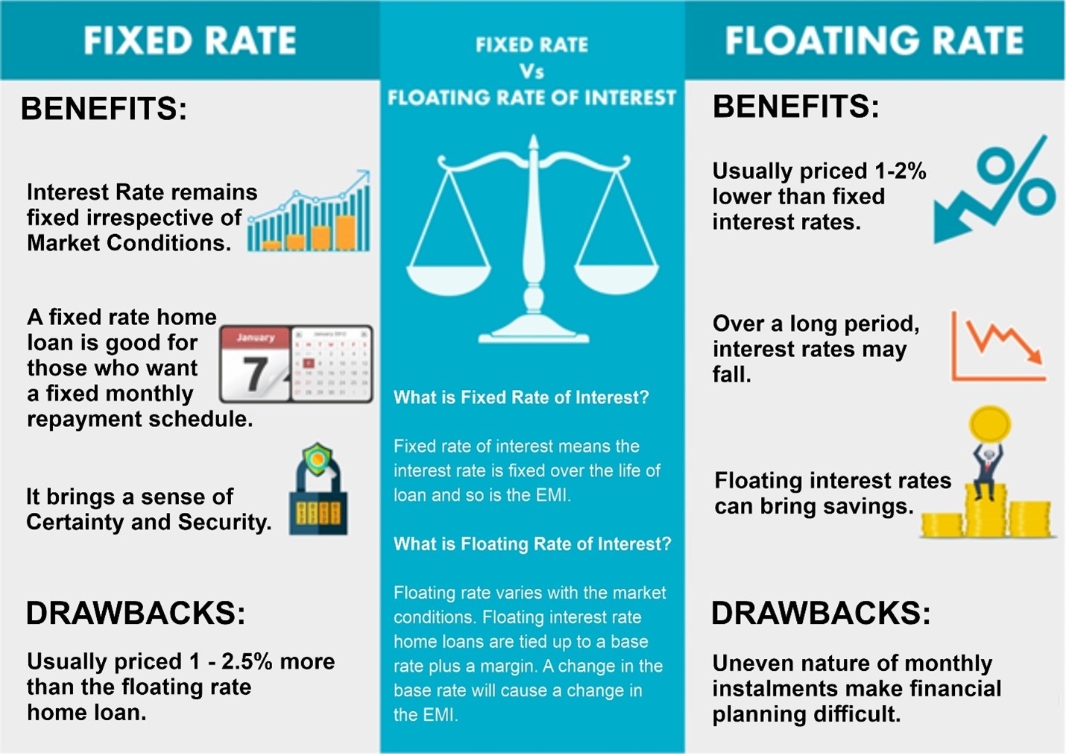

In a lending situation, Interest rates can be “fixed or floating”. Floating rates normally refer to a spread over a market benchmark rate i.e LIBOR. A Fixed Interest Rate means that the rate of interest will remain the same throughout the loan period i.e fixed at say 12%. Fixed rates are often used in federal student loans and mortgages (i.e in long term loans).

HOW IT WORKS

For example, if the interest rate is fixed at 12%, it will remain at 12% throughout the entire loan period. It is not affected by market fluctuations and remains constant throughout the loan period.

ADVANTAGES

A fixed interest rate has many advantages:

- STABILITY - There is a certainty in the repayment amount through the period of the loan in the mind of the borrower. Also, the borrower has full transparency on the Equated monthly instalment (EMI) through the life of the loan.

- PROTECTION FROM SUDDEN INCREASE IN OVERNIGHT RATE - The borrower has no need to worry about a sudden increase or decrease in the overnight rate as it will have no effect on the fixed interest rate, they are obligated to pay.

- USEFUL WHEN TAKING A LONG-TERM LOAN - A fixed interest is better when taking a long-term loan as there are likely to be multiple market fluctuations in interest rates over the long term. Therefore, taking a loan with a fixed interest rate is safer for the borrower as they are not exposed to any interest rate fluctuations during the tenure of the loan.

DISADVANTAGES

- However, the fixed rate loans are usually priced higher than comparable floating interest rate loans.

- Customer does not benefit from a drop in market benchmark interest rates - If the overnight or LIBOR (benchmark rate) rate drops, the floating interest rate tends to drop too, so if there was a sudden decrease in the overnight rate, the amount needed to be paid back to the lender would be lower in a floating rate structure and the borrower gives up this benefit, if they lock on to a fixed rate option.

FLOATING INTEREST RATE

A floating interest rate means that the rate paid by the borrower moves up and down in line with market based interest rates. It is also known as variable interest rate as it varies over the loan period. It is the opposite of fixed interest rate and the interest rate and interest amount amount payable changes according to the market rate. Very often a floating rate is quoted as a margin over a benchmark (over night or interbank rate) i.e the interest rate is LIBOR (London interbank overnight rate) + 2.5%. LIBOR is fixed for 6- or 12-months period and as LIBOR moves so does the rate, the rate gets refixed / reset every 6/12 months.

HOW IT WORKS

The floating rate benchmark used by Ummeed is the Ummeed reference rate – URR (Published on the company website). The URR is determined by multiple factors i.e. RBI (Reserve Bank of India) repo rate, Ummeed`s cost of funds etc. The customer is typically changed a certain margin over the URR. The margin is fixed by product category, customer risk categorization etc.

Ummeed Reference Rate (URR)

– Ummeed`s Reference rate plays an important role determining the value of the floating rate.

If Ummeed`s Reference rate decreases then the floating interest decreases, lending to a lower EMI (Equated Monthly Instalments), but if the Ummeed`s Reference rate increases then the floating interest increases, leading to a higher EMI.

For example, if the margin is 2% and the the URR is 12% at the moment, the floating rate is 14%. However, if there is an increase in the URR to 14%, the floating rate increases to 16%. Similarly, if the URR decreases to 10%, the floating rate reduces to 12%.

ADVANATGES

- A Floating interest rate is a riskier option for the borrower than a fixed interest rate, but it is advantageous when the interest rates in the market are expected to drop:

- A Decrease in market interest rate - If there is a decrease in the market interest rates, the URR will decrease causing the floating interest rate to drop. This will reduce the repayment amount (EMI).

DISADVANTAGES

The only downside to a floating interest rate is that: -

- A sudden increase in market rate - A sudden increase in the market rate, will cause the URR to rise causing the floating interest rate to increase. This will increase the EMI

-repayment amount.

Conclusion

The choice between a fixed and floating interest rate for a borrower depends on their risk appetite and view on interest trends in the period of the borrowing. Most risk averse borrowers, taking long term loans may like to fix their liability by taking a fixed interest rate loan.

- Share